Projects

Murchison Gold

Project

Western Australia

The Murchison Gold Project (MEK 100%) covers the northern extent of the highly prospective Mount Magnet and Youanmi Shear Zones in the prolific Murchison Gold Fields of Western Australia.

The project is located adjacent to several multi-million ounce gold mines and includes 281km² of granted Mining Leases and Exploration Licences. The project hosts a high grade 1.2Moz Mineral Resource with all Mineral Resources located on granted Mining Leases, hence there are minimal impediments to production.

The Company is also progressing through a staged pathway to mine development. A Feasibility Study was released for the Murchison Gold Project in July 2023, which outlined a flexible and straightforward development strategy. The study delivered meaningful production and financial outcomes, including an average annual gold production of 80,000oz over the first eight years, with peak production of 103,000oz in year six.

The Company’s recent drilling programs have targeted extensions to the Turnberry and St Anne’s deposits, also within the Fairway shear zone and 3.5km along strike to the south of Turnberry.

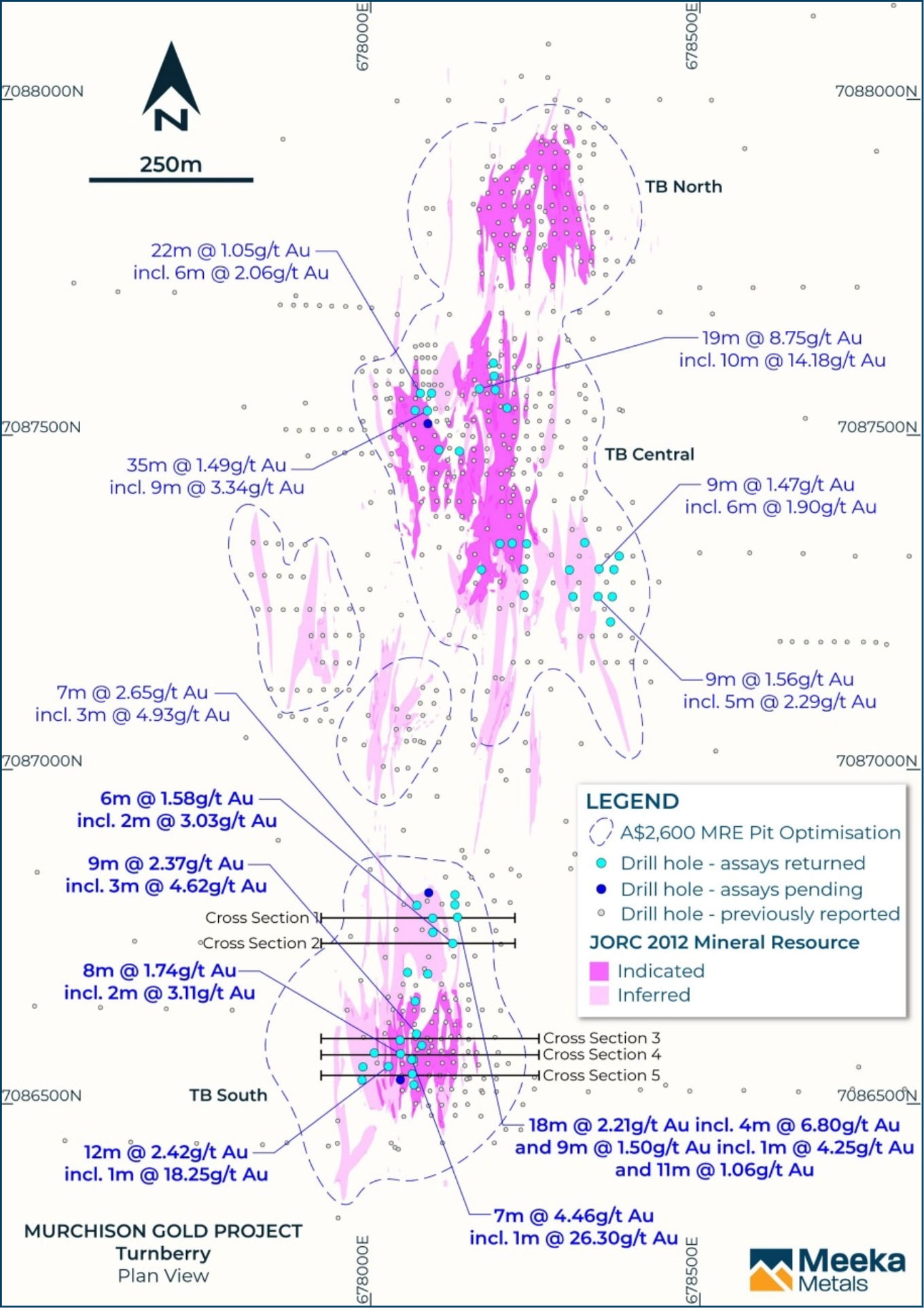

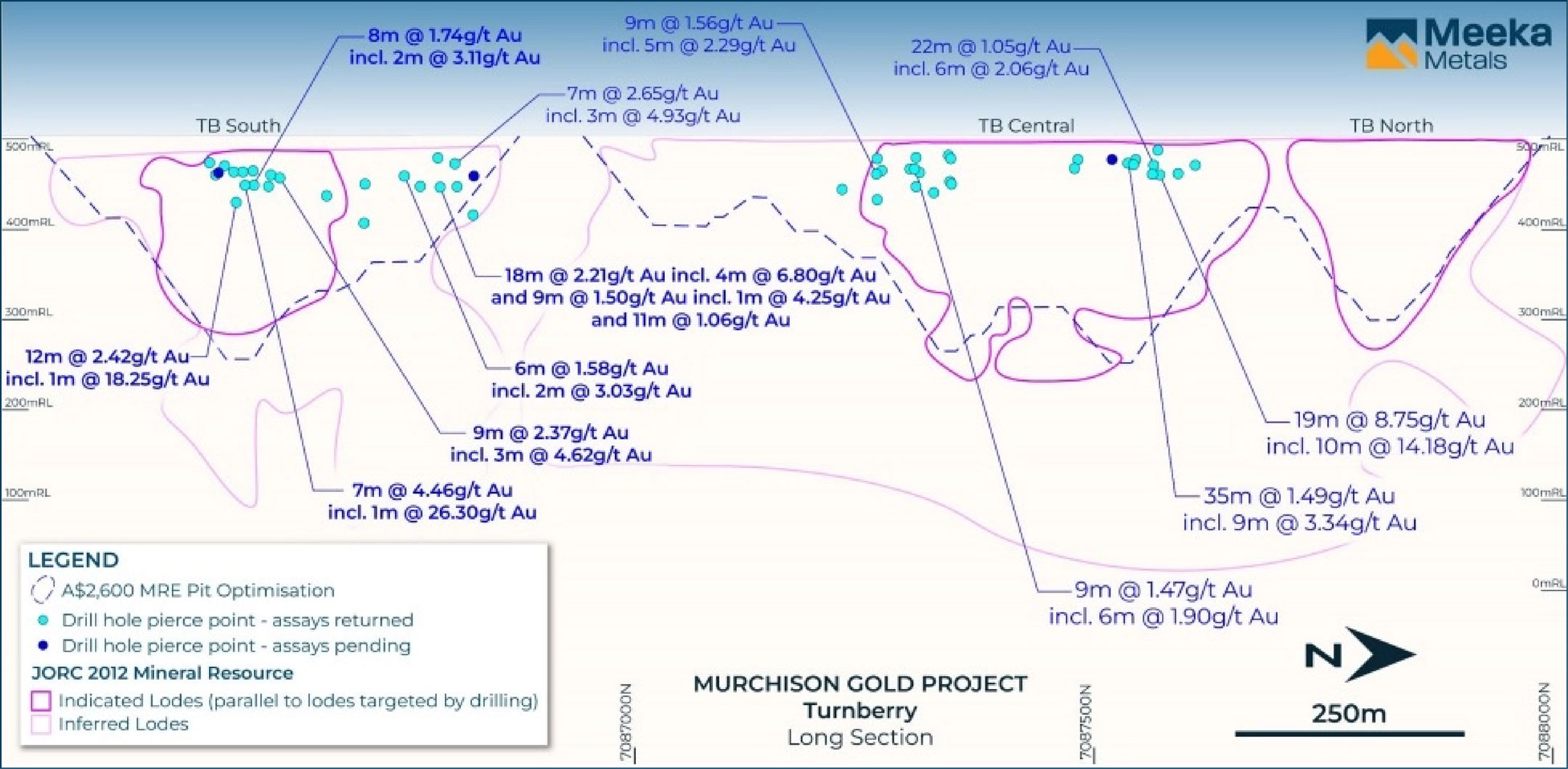

Turnberry

Turnberry hosts broad zones of shallow, high-grade gold. The Mineral Resource averages ~1,600 ounces per vertical metre from surface to a depth of 200m where the density of drilling reduces. The deposit has a strike length of 1.7km and remains open at depth. Significant drilling results include:

- 41m @ 4.8g/t Au from 148m (TBRC062)

- 23m @ 7.1g/t Au from 69m (TBRC208)

- 9m @ 10.4g/t Au from 162m (TBRC070)

- 18m @ 4.7g/t Au from 192m (TBRC092)

- 18m @ 3.4g/t Au from 154m (TBRC221)

- 37m @ 2.8g/t Au from 209m (TBRC316)

- 16m @ 6.7g/t Au from 20m (21TBRC014)

- 32m @ 3.1g/t Au from 32m (22TBAC011)

A ~6,400m infill and extensional drill program completed in the December 2023 quarter delivered strong results. Broad zones of oxide gold were intersected, including:

- 19m @ 8.75g/t Au from 48m including 10m @ 14.18g/t Au (23TBAC026)

- 18m @ 2.21g/t Au from 60m including 4m @ 6.80g/t Au (23TBRC001)

- 35m @ 1.49g/t Au from 30m including 9m @ 3.34g/t Au (23TBAC019)

- 12m @ 2.42g/t Au from 76m including 1m @ 18.25g/t Au (23TBAC039)

- 12m @ 2.19g/t Au from 57m including 3m @ 7.12g/t Au (23TBAC044)

- 7m @ 4.46g/t Au from 67m including 1m @ 26.3g/t Au (23TBAC045)

- 9m @ 2.37g/t Au from 47m including 3m @ 4.62g/t Au (23TBAC046)

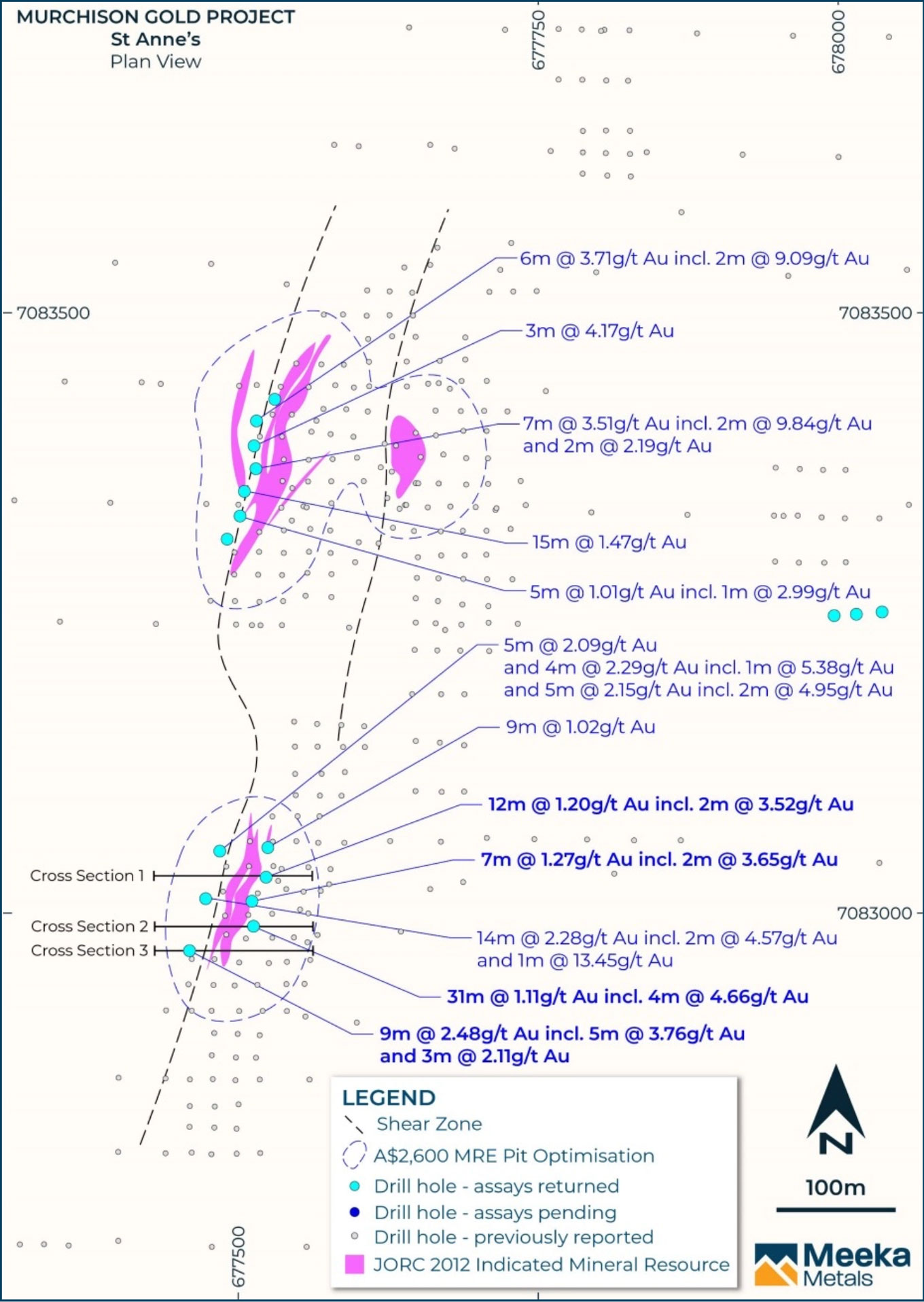

St Anne’s

Drilling supporting the Mineral Resource for St Anne’s includes:

- 32m @ 16.07g/t Au from 48m including 16m @ 28.59g/t Au (22SAAC058)

- 20m @ 20.74g/t Au from 48m including 16m @ 24.86g/t Au (22SAAC061)

- 24m @ 4.73g/t Au from 52m including 8m @ 11.78g/t Au (22SAAC100)

- 36m @ 3.61g/t Au from 44m including 8m @ 11.07g/t Au (22SAAC083)

- 32m @ 2.20g/t Au from 48m including 20m @ 3.31g/t Au (22SAAC009)

- 32m @ 2.03g/t Au from 44m including 16m @ 3.59g/t Au (22SAAC018)

- 28m @ 1.47g/t Au from 28m including 8m @ 3.46g/t Au (22SAAC005)

- 24m @ 4.81g/t Au from 68m including 4m @ 20.30g/t Au (21SARC002)

- 36m @ 1.02g/t Au from 24m including 8m @ 2.35g/t Au (21SARC004)

Mining Studies

The Murchison Gold Feasibility Study was released in July 2023, outlining a straightforward development strategy that delivers meaningful production and financial outcomes for the Company over an initial 9.3 year production plan.

Key Feasibility Study outcomes include (all in Australian dollars):

- Average annual gold production of 80,000oz over the first eight years, with peak production of 103,000oz in year six

- Recovered gold production of 663,000oz over 9.3 years (8 years mining, 1.3 years stockpile processing)

- Initial Probable Ore Reserve of 4.1Mt @ 3.1g/t gold for 410,000oz

- 92% of production in the first three years is from Measured and Indicated Mineral Resources

- Undiscounted free cash flow (after capital and pre-tax): $363M ($2,750/oz) and $521M ($3,000/oz)

- Net Present Value (NPV5%) pre-tax: $249M ($2,750/oz) and $371M ($3,000/oz)

- Internal Rate of Return (IRR) pre-tax: 40% ($2,750/oz) and 56% ($3,000/oz)

- Payback following process plant commissioning: 22 months ($2,750/oz) and 16 months ($3,000/oz)

- All-in Sustaining Cost (AISC): $1,684/oz

Forward Strategy

The Company’s strategy in relation to the Murchison Gold Project is to rapidly expand the Mineral Resources through drilling while concurrently completing studies to advance to a development ready state for the project.

Mineral Resource growth will focus on near mine targets identified through geophysics and in drilling areas that have not received sufficient follow-up. Key target areas include shallow, high-grade gold mineralisation at St Anne’s, which is not yet included in the Mineral Resource estimate, extensions to the 685,000 ounce Turnberry deposit and a number of compelling geophysical targets within the 7km long Fairway shear zone along strike from Turnberry.

A gravity survey was completed over 7km’s of the Fairway Shear Zone (including St Anne’s and Turnberry) in September 2023, with results expected to delineate denser mafic rocks, the principal host to gold mineralisation within the belt.